what is fsa health care contribution

There are a few things to remember when it comes to establishing and then spending from your Healthcare FSA. Easy implementation and comprehensive employee education available 247.

What Is An Fsa Definition Eligible Expenses More

And vision care expenses.

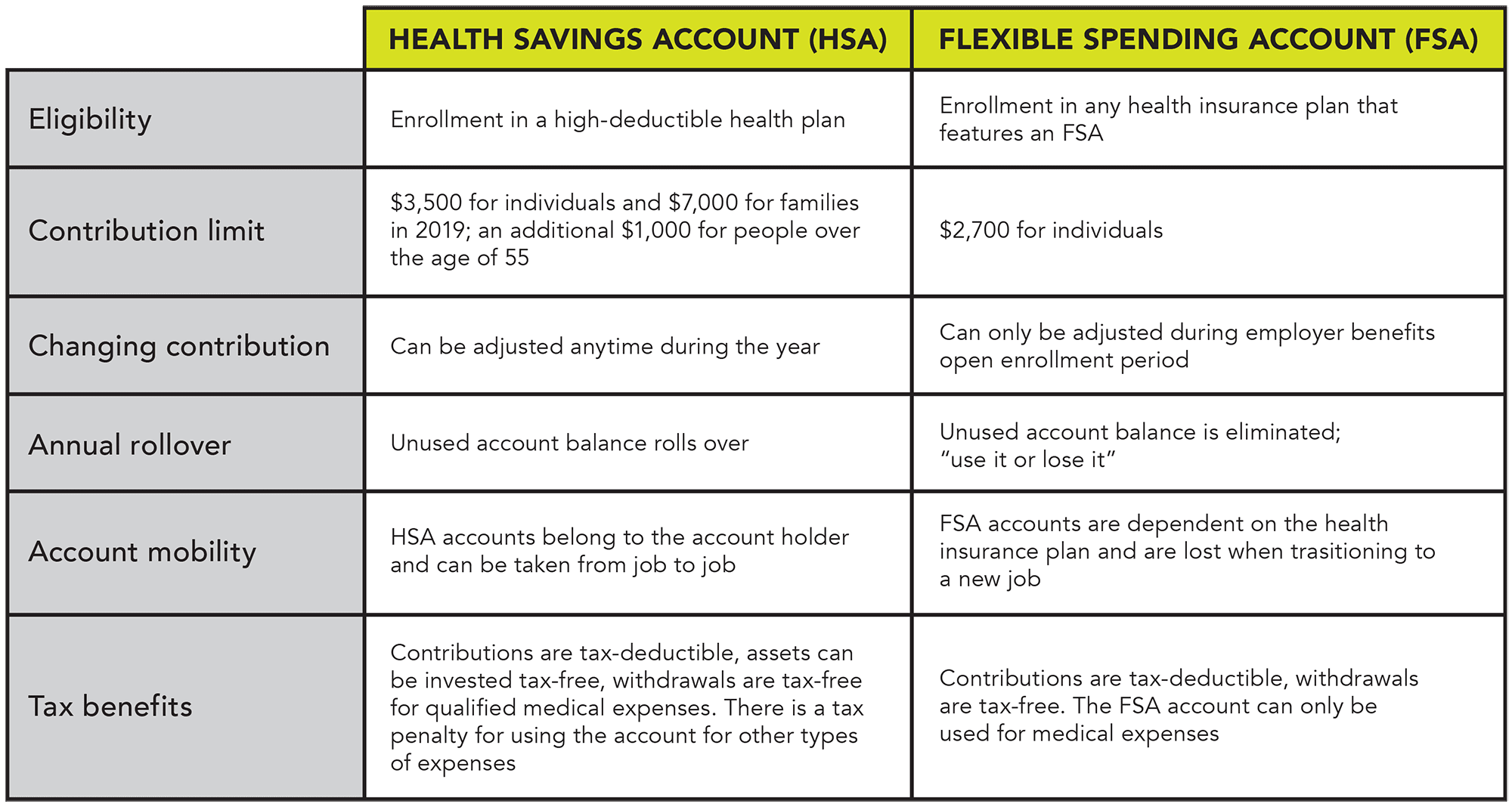

. As a result the IRS has revised contribution limits for 2022. Employers may make contributions to your FSA but arent required toA Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocketout-of-pocketYour expenses for medical care that arent reimbursed by insurance. What is an FSA.

Only you and your employer can put money in an FSA up to a limit set each year by the IRS. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

For example if you earn 45000 per year and allocate 2500 to your FSA for health care expenses your estimated tax savings from your FSA is 812. You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. Ad Save on fsa and hsa approved items.

Your employer provides and owns the account. An FSA is owned by your employer and if you dont spend the money by the end of the plan year it remains with your employer with certain limited exceptions. Get a Quote Now.

Flexible Spending Account - FSA. Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850. Get a free demo.

Get a free demo. Elevate your health benefits. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision. A Health FSA is a part of an employers Section 125. The maximum carryover amount.

The health FSA contribution limit will remain at 2750 for 2021. Keep in mind you may carry over up to 57000 remaining in your account from one plan year to the next. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022.

See contribution information to your Health Care FSA each year. A Health FSA is a part of an employers Section 125 plan that allows employees to set aside pre-tax dollars to pay for out-of-pocket medical expenses. Ad Join 2 Million Satisfied Shoppers weve Helped Cover.

Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences. It remains at 5000 per household or 2500 if married filing separately. Second your employers contributions wont count toward your annual FSA contribution limits.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. A Flexible Spending Account FSA is a type of savings account available in the United States that provides the account holder with specific tax advantages. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can. 10 as the annual contribution limit rises to 2850 up from.

This means youll save an amount equal to the taxes you would have paid on the money you set aside. An FSA is a financial account that employees can fund with pretax contributions. Health Care FSA.

You contribute funds to an HSA and FSA but only your employer can contribute to your HRA. For one self-employed individuals. You dont pay taxes on this money.

Basic Healthcare FSA Rules. During the employers open enrollment period each year every employee determines how much to set aside for the health FSA contribution by estimating eligible out-of-pocket medical expenses. Fact checked by.

8 You can use the funds in your FSA to pay for qualified medical or dependent-care expenses. A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses. Free 2-Day Shipping with Amazon Prime.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Check the Newest Plan Options. The Savings Power of This FSA.

In general an FSA carryover only applies to health care. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Flexible spending accounts FSA can be used to save money on health-care expenses but youll need to know about the carry-over. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more. Contribution limits apply.

You can contribute up to 2750 in 2021 and 2850 in 2022 into your. With HRAs employers may limit which health expenses are eligible and the amount. Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs.

The contributions you make to a flexible spending account FSA are not tax-deductible because the accounts are funded through salary deferrals. Ad Custom benefits solutions for your business needs. But heres the dealin order to use the calculator to accurately estimate your health care.

Affordable Healthcare Coverage for Families Individuals. Other key things to know about FSAs are. FSAs are a use it or lose it account.

Flexible Spending Accounts Or Fsas What To Know Before You Opt In Contribute Or Spend

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

10 Things You Absolutely Need To Know About Employee Benefits Employee Benefit Health Insurance Companies Health Care Insurance

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Fsa Carryover What It Is And What It Means For You Wex Inc

Employee Compensation Plan Template Beautiful Employee Pensation Plan Example Sample Pay Plans Sales How To Plan Business Budget Template Free Word Document

Hsa And Fsa Accounts What You Need To Know Readers Com

Hra Vs Fsa See The Benefits Of Each Wex Inc

What Is An Fsa Definition Eligible Expenses More

What Is A Flexible Spending Account Clydebank Media

Get Our Image Of Lawn Care Business Budget Template For Free Budget Planner Template Household Budget Template Business Budget Template

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Fsa Contribution Limits 2021 Health Savings Account Personal Budget Personal Finance Advice